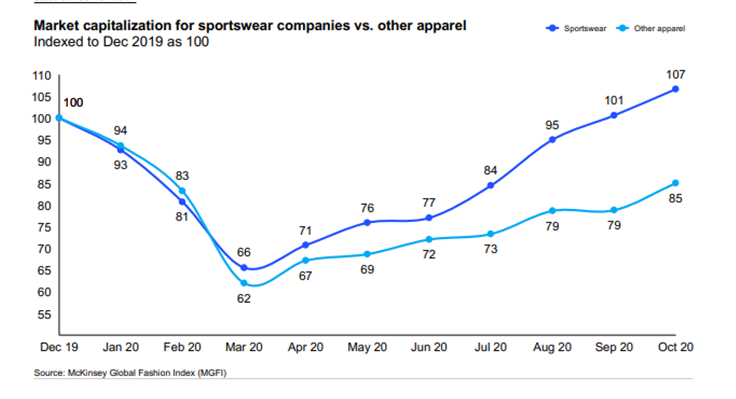

COVID-19 pandemic is reshaping the fashion industry. Despite this globally extended challenge, sportwear companies have been more resilient than the rest of apparel industry and is expected to continue growing, recovering much faster as revelled by the study “Sporting Goods 2021 ”carry out by McKinsey & Company in 2021 (see table below).

This positive effect has been caused because many consumers tried to find ways to be active in order to improve their mental and physical health, especially during lockdown restrictions. According a survey carry out by McKinsey & Company (2021a) the reasons could be attributed to more time available, new exercise offerings, and more awareness in well-being. According to a McKinsey & Company (2021b) research carry out during 2021, there are six dimensions in the wellness market (see image below) that have been gaining momentum over time

Due to this fact, brands are starting to provide multi-dimensional experiences, and incorporating these dimensions across their business strategy, to meet the consumer’s needs and trying to connect with their values and emotions.

New Trends and Customer Habits Change

The massive shift to online shopping, accelerated by COVID-19 pandemic, has forced companies to rethink their business models, putting digital channels at the centre and incorporating digital fitness solutions, enabling remote exercising offering community and incentive elements. According McKinsey&Company (2021a), digital fitness will not fully replace the traditional sports but, will continue existing in a hybrid model.

“Sustainability is now part of the cost of entry, it cannot be an afterthought”, said C. Browne, COO of Under Armour. Sustainability is becoming one of the biggest drivers in the customer purchasing behaviour, mainly adopted by the millennial generation who are more concerned about environment and its social impacts. According to a apparel survey carry out by McKinsey in 2021 “Today, more than two thirds of consumers say that they consider sustainability issues when making purchasing decisions, and the number will likely rise in 2021”.

Taking these trends into account, Lululemon, the Canadian technical athletic brand, invest in community and bought the fitness start up “Mirror” to offer personalized remote exercise through a wall mounted machine for streaming workout classes. In terms of personalization a fitness-tech startup developed a fitness tracker to provide personal coaching. Based in collected physiological data it provides personalized sleep and fitness information to users. In another example, Sephora’s, the French multinational retailer of personal care and beauty, has launched in partnership with the american premium wellness brand “The Nue Co” a sustainable line of probiotic supplements, skincare and calming functional fragrances to reach a new market.

Brands will have to meet today’s challenges by adopting new business models depending on which dimensions they want to play and how they want to succeed. To face these changes, they will require a range of new capabilities and exploring new alliances to scale their operations into new segments. Of course, these are changing time where there will be winners and losers. While the impact of COVID-19 is likely disappearing over time, life will not be as it was before.