During week one, we explored the importance of having a sound understanding of the magazine industry in terms of circulation, types of magazines and their successes or weaknesses. In order to do this we are gathering statistics in our research to enable us to have a clear set of industry facts and figures to refer to throughout the magazine production process.

Digital influence

“The magazine industry is increasingly dominated by large companies. Not surprising, perhaps, but it’s not long since the arrival of new computer technology brought with it the hope that it would become so cheap and easy to produce magazines that anyone would be able to do it. For some this meant a real possibility that a new democratised magazine publishing industry would open up its arms to smaller, minority interests. It hasn’t happened quite like that. It is now more expensive than ever to launch a magazine brand, although a company such as Future Publishing demonstrates how quickly a new commercial publisher can, in just a few years, become one of the UK’s largest companies.” (McKay 1953)

This highlights the emerging digital world overpowering print, however how with the right tactics success with print is still possible. Bearing this in mind, we can use social media and the internet for a publication like the Yorkie.

How much is the UK magazine industry worth?

- The UK is a leading publisher of newspaper and magazine titles.

- The UK customer publishing industry is the most developed in the world and is worth over £1bn each year.

- There are over 3,210 consumer magazine titles in the UK, reaching 87 per cent of the total adult population. UK consumers will spend an estimated £2.5bn on magazines in 2013.

Latest circulation figures in UK and top 3

I found different magazines at the top, from different sources and across time. I evaluated the sources and concluded that the Mediatel newsline ABC data is the most accurate and up to date but I still included other internet sources to display a range.

ABC-Consumer magazine market:

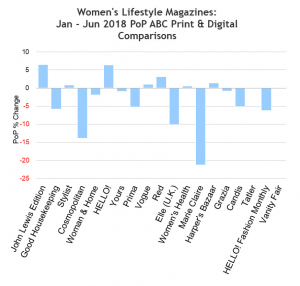

1) Womens Lifestyle

John Lewis edition is at the top in the women lifestyle category-this free magazine now has a circulation of 475,400.

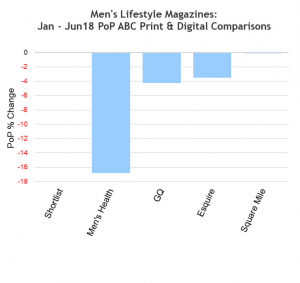

2) Mens Lifestyle:

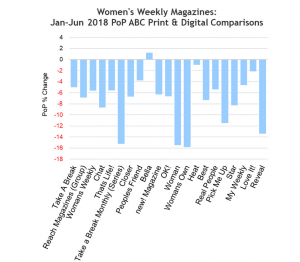

3) Women’s Weeklys

4) News and Current Affairs

The Economist remains the UK’s most popular news and current affairs title with a circulation of 267,300.

5) TV Listings

Bauer’s TV Choice continues to lead the market with a circulation – entirely in print – of 1.17 million. The category is in decline and drops significantly after Christmas.

6) Home Interest

RHS Media’s The Garden continues to lead the home interest magazine market with an overall circulation of almost 435,000.

Here are some other internet sources and older figures which reflect how things have changed.

According to this source from 2017, the National Trust Magazine was number 1 in the previous top 10 UK magazines, full of behind-the-scenes stories and beautiful photography. This is followed by slimmingworld.co.uk magazine published seven times a year, it’s the U.K.‘s best-selling title in the health and diet sector, with a print circulation of 640,000.

This data demonstrates the alternating trends within the industry.

Winners and Losers?

The top performers and losers in 2017:

The top performers:

- Garden Answers: up 41% to 27,957

- Times Literary Supplement: up 27.6% year to 32,166

- The Spectator: up 15.2% to 82,585

- Good Housekeeping: up 11% to 454,697

- New Statesman: up 5.3% to 34,025

- London Review of Books: up 4.4% to 70,468

- Country Living: up 12.5% to 188,915.

Biggest fallers:

- Glamour: down 25.6% to 260,422

- Look: down 22.2% to 90,315

- Star: down 17.6% to 122,630

- Heat: down 16.5% to 136,470

- Empire: down 15.3% to 123,004

- Hello!: down 15.5% to 225,986

- Now: down 17.3% to 104,937.

Exploration of different types of magazines:

McKay, J. (2013) The Magazines Handbook Abingdon, Routledge:

Consumer magazines are titles related to hobbies or special interests such as cars (Classic Cars, Top Gear Magazine). They include adverts that encourage readers to buy something. Titles are not clearly about one activity or interest they are often based on lifestyle: most of these are for women and girls, but since the early 1990s several new ones have been aimed, initially with spectacular success at the men’s market e.g. (Nuts).

B2B/Business to Business magazines (or trade or professional) are all those publications whose aim (in addition to making money) is to provide news in a limited field to a tightly targeted audience. In these publications display ads tend to be for jobs. Roughly 5000 titles in UK.

Range or Trade Publications cover topics only relevant to those working in that particular industry and offer news and information including new product listings, feature articles, and Q&A interviews.

Subscriptions account for about one-quarter of the trade press circulation, most are circulated free of charge on what is called a ‘controlled circulation’ basis. This means readers qualify to be sent a copy under whatever terms the publisher establishes.

Customer magazines are found in supermarkets, shops etc such as Tesco and Asda, with Sky being the top with a circulation of 6,874,090.

It is interesting to see how the consumer category makes up for most of the UK’s titles in newsagents They may be general with a purpose to entertain and inform (such as GQ, Elle, Radio Times) or consumer specialist which are aimed at a specific interest or hobby (Car, Total Film, Gardeners’ World). There are about 2,800 UK consumer magazines. Consumer magazines are clearly the providers of the most success in gaining the most revenue.

Big companies in the industry?

IPC Media, the UK’s largest magazine publisher by circulation optimistically claimed “a resurgence in the women’s lifestyle market” and continued growth in the home interest sector.

Bauer Media, there were pockets of growth from its established brands, including Yours (+0.5%) and Empire (+2%), while Grazia added nearly 4,000 weekly digital editions.

Condé Nast highlighted its UK brands now reach a combined gross audience of 33,551,771 for its portfolio.

Circulation at the fashion bible Vogue continues to be stable at 200,032 ahead of plans to launch interactive mobile editions this autumn.

Immediate Media noted its BBC Worldwide food portfolio had “outperformed the core food market period-on-period”, with 25 year old BBC Good Food Magazine posting a combined ABC figure of 236,865.

Hearst grows “brand reach” -Good Housekeeping, the 92 year old monthly, ensured publisher Hearst Magazines had something to shout about, increasing its lead over former leader Glamour to be crowned the UK’s top monthly women’s lifestyle magazine for the second successive report.